Your mortgage is an alternative form of life insurance

-

benefit 1

Your mortgage is an alternative form of life insurance

SEE MORE ▶︎ -

benefit 2

Rental income can used as private pension income

SEE MORE ▶︎ -

benefit 3

Tax deductions for income and resident tax

SEE MORE ▶︎ -

benefit 4

An alternative to high-yielding deposits

SEE MORE ▶︎ -

benefit 5

A useful offset against inheritance tax

SEE MORE ▶︎

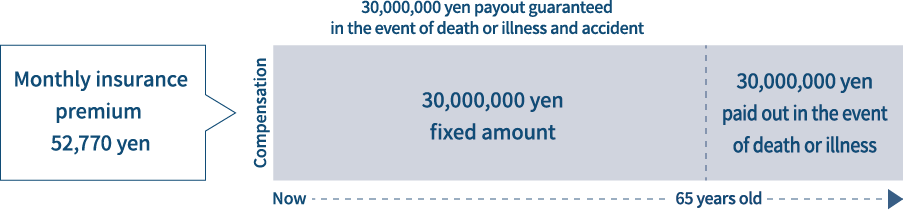

If you use a housing loan or mortgage for your condominium management activities, you need to possess a particular type of credit insurance known as “group credit life insurance.” This is a policy wherein the balance of a mortgage is paid by the insurance company if the insured person dies or suffers a severe disability during the repayment of the mortgage or is diagnosed with a disease covered by special policy provisions, such as cancer. Typically, group credit insurance premiums are included in the mortgage interest rate. Rental income can be used for repaying the loan, and hence, the monthly cost of your repayments can be significantly reduced compared to stand-alone insurance premiums. In an unlikely event wherein the remaining debt needs to be paid by the insurance company, the policy holder may have peace of mind in that the underlying asset would still remain in the hands of family. If the property is sold, the family receives a considerable sum of money; if the property is retained, the family benefits from rental income.

Comparison between general life insurance andcondominium asset management

■ General life insurance (30,000,000 yen life insurance)

■ Asset management (Condominium management)

(30,000,000 yen purchase and subscription to group credit insurance)

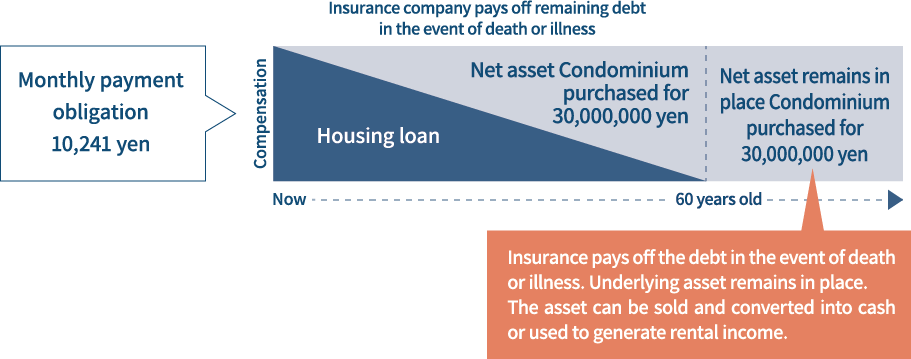

Rental income can used as

private pension income

Japan is renowned for having one of the highest rates of life expectancy in the world. If you are 60 years old, you can expect to enjoy another 21 years of life without having to work if you are a man or a further 27 years if you are a woman. The effects of a declining birthrate and an accelerating aging rate are exerting extreme pressure on the public pension system. Medical expenses incurred after the age of 70 can run to over 10 million yen, with some surveys suggesting that this can be up to 50% of total lifetime medical costs. Covering the costs of life after retirement out of savings and deposits can amount to several million yen. Our suggestion would be to fund this expenditure with a stable rental income from condominium management. If you set up a repayment plan to pay your mortgage before you retire, then you can use your monthly rental income to fund your life after retirement. In this way, you can ensure financial stability in later life without being solely reliant on a public pension.

Years of life postretirement (assuming retirement at the age of 60)

■ General life insurance (30,000,000 yen life insurance)

Necessary expenditure postretirement

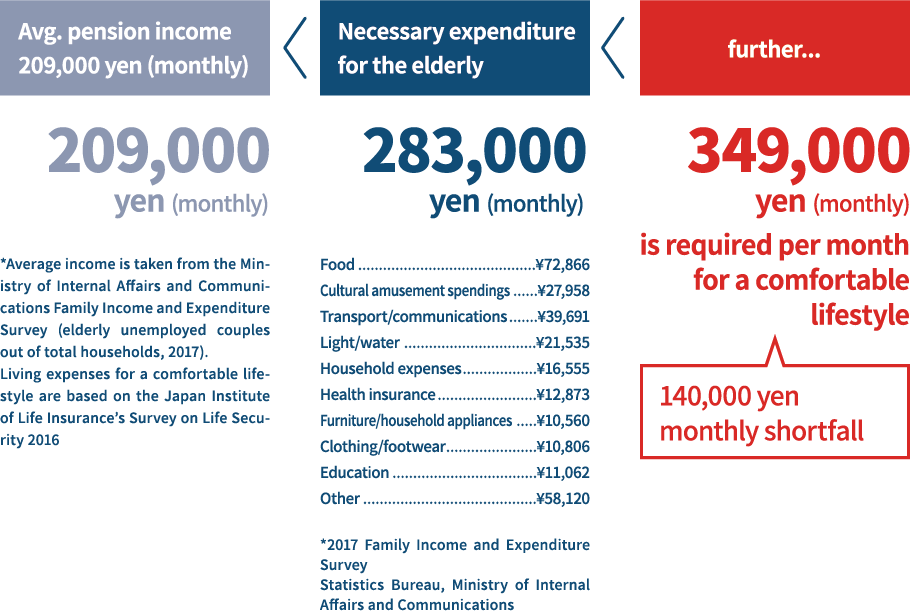

Tax deductions for income and resident tax

If you lease the apartment you have purchased to a third party, the income you generate is “real estate income.” With respect to rental income, if you have a mortgage, then interest costs and depreciation (which is not a cash cost) are counted as tax deductible expenses in addition to property taxes and building management costs. Real estate income is accounted as a loss (negative income) if your book spend exceeds your income. Subtracting this deficit from income earned on your final income tax return (total profit or loss) enables you to claim an income tax rebate and a reduction in resident tax.

Aggregation of profit and loss

An alternative to high-yielding deposits

In an era of ultra-low interest rates, the yield (interest) from savings and deposits has become almost negligible. On the contrary, condominium management offers you a stable asset that is capable of generating annual rental income of 800,000–1,200,000 yen on an average. A condominium in central Tokyo has an average yield as high as 4%–6%.

Annual yield comparison with bank products

A useful offset against inheritance tax

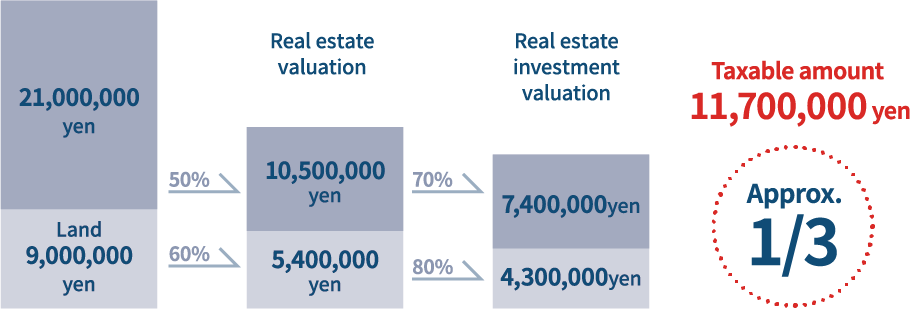

It is natural to look at ways of reducing the potential burden of inheritance tax on bereaved relatives in advance. In terms of valuing an inheritance, cash and securities are considered at face value, while investment condominiums offer a tax deductible discount. For tax valuation purposes, the building (fixed asset) is valued at 50%, and the land is valued at about 60%–80% of the prevailing market price. Furthermore, as the asset is leased out for investment purposes, the taxable value of the investment is only 70%–80% of this valuation. Therefore, in terms of cash, the final asset valuation for tax purposes might be equivalent to 30%–50% of the original market value.

Assessment of inheritance tax when purchasing a condominium

■ Inheritance via purchasing a condominium

■ Inheritance via purchasing a condominium

-

A wealth of experience and know-how cultivated over many years

PIM will celebrate its 20th anniversary in 2021.

If you feel you lack knowledge or experience in condominium management, there is no need to be concerned. We will work closely with you, offering constructive advice and support. -

Product expertise

We only introduce profitable locations to our clients. Our sales are focused on areas such as the 23 wards of Tokyo where you have the prospect of long-term stable rental returns.

-

Our leasing management track record

As of September 30, 2019, we had 3,064 units under our management, with an occupancy rate of 98.7%. Moreover, if you use PIM’s “Master Lease” rental management service, you can minimize the vacancy risk. This saves the owner from being involved with the inconveniences of condominium management.

Company employee / manufacturing industry

male in his 30s

owns four properties with eight years of ownership

-

T.I. became the owner of a studio apartment in his late 20s on the recommendation of a senior colleague at work. He travels a lot for business and often gets home late. Investing in real estate, with its medium- to long-term return horizon, seemed like a suitable option for him as opposed to other forms of investment where you need to stay up to date with daily developments. Life postretirement is always at the back of his mind; however, for now, he is keen on enjoying himself. We spoke to T.I. about this.

-

Q.Why did you start investing in real estate?

-

Some of my more experienced colleagues at work recommended it. I was in my late 20s at that time, but I was gradually building up my savings, and I thought it might be a good idea to invest some of the money I had left over from my daily spending. I could have opted for stocks or FX, but I went for real estate investment, as it was so easy to get started and to get involved in. Stocks and FX are always fluctuating, so you constantly have to stay on top of what is going on. I thought that a long-term view would be more of an advantage for investing in real estate, especially studio apartments.

-

Q.Did you feel at all nervous about starting to invest in real estate?

-

Of course, I did! There were plenty of old hands at work I could talk to, but even so, there was still so much that I did not really understand. The thing that I was the most worried about was money, as you’d expect. There were plenty of stories on the internet about people who had gone bankrupt through investing in real estate. But, I think it’s my personality; I don’t like overthinking and just doing nothing. I would rather just give something a go; so, although I was nervous, I decided to take the plunge.

Also, the PIM sales staff carefully explained all the risks to me, as well as the benefits, so that helped soothe my concerns. I’d have been a bit suspicious if they’d focused on the positives! (Laughs). -

Q.Why did you choose PIM as your investment partner?

-

It’s hard to put my finger on it, but I just felt they were on the same wavelength as me. I would have been uncomfortable if they had just aggressively sold the product to me; but equally, I would have been unhappy if they had not come up with any suggestions at all. Looking back on it, I think they evaluated my situation and adjusted their approach accordingly. I rely on them, and their admin and reporting are good, so I think they are a reliable partner. I like the way that they are always there to talk about real estate investment when something comes up or when I am not sure about something.

Company employee / service industry

female in her 40s

owns eight properties with three years of ownership

-

C.M, a studio apartment owner, is planning for life postretirement in a few decades’ time. She was interested in investing anyway; out of the many financial products on offer, she chose real estate investment because of the long-term perspective and the opportunity for diversification. We spoke to C.M. about her investment decisions and her cautious approach.

-

Q.Why did you start investing in real estate?

-

Some of my best friends invest in real estate. They recommended it to me, and that is how I started. I have some experienced colleagues who are happy to give me advice on all sorts of things, and I have spoken with them on a variety of topics. I said, “I am interested in investing. How should I go about it?” They encouraged me to invest in real estate, which is easy to get started in. I wanted something with a long-term perspective, and because I wanted diversification, real estate was exactly the right thing for me.

-

Q.Why did you choose PIM as your investment partner?

-

The deciding factor was the strength of their properties. They concentrate on location and design; that is what I really liked! Also, I feel very reassured about the company’s philosophy and approach. Before starting out in real estate, I went along to a real estate investment seminar held by PIM to find out more about the company and the kind of properties they have. I also wanted to find out more about the sector in general. The lecture was easy to understand, and I liked the interaction with the staff. I got a proper insight into the company, and I was very impressed. So, I thought it made sense to go to PIM when I started investing in real estate.

-

Q.What are your plans for the future?

-

I still have a long way to go before retirement, but I want to be well-off and live comfortably after I retire. By “well-off,” I’m talking about a state of mind. I want to have sufficient money available so that I can comfortably live the lifestyle I want to live. So, I think about the kind of lifestyle I want to have when I retire, and I work out roughly how much income I need to generate from the rent to pay for this. I want to earn a bit more than what I am getting at the moment as rent; so, I am thinking about timing, and I plan to buy some more properties in due course.

-

vol.1

Private consultation

If you are interested in condominium management, please apply for an individual consultation using an application form. You will meet with a PIM sales representative who will explain everything to you, beginning with the basics. We will follow-up on any questions or concerns you may have until you are completely satisfied. (Everything is conducted in Japanese.)

-

vol.2

Property introductions; overview of the area; purchase application

We at PIM are happy to recommend some of the properties we currently own. We can also provide applicants with information about the area (although we cannot show you the rooms within the properties that have already been sold or leased). If you find a property that you like, you can make a purchase application.

-

vol.3

Conclusion of sales agreement

Once we have explained the key items set forth in business law, the sales agreement is signed.

-

vol.4

Application for loan screening and review

If you want to take a loan, we will arrange a financial institution to act as an intermediary for you. We will provide you the information on the documents required for the loan application and will submit these to the financial institutions on your behalf (provided that you are a permanent resident in Japan).

-

vol.5

Conclusion of loan agreement

After the loan review is approved, a loan agreement is established with a financial institution. Depending on the financial institution, you may need to have an interview with a loan manager. A PIM staff member will be present during the interview.

-

vol.6

Handover of property; loan repayments start

Your bright future in condominium management begins!

-

vol.7

Rental management service starts

If you subscribe to the “Master Lease,” our rental management service, you will benefit as follows:

・100% rent guaranteed even if the tenant is delinquent;

・Repair guarantee for all interior equipment failures;

・Tenant recruitment: contracts and agreements will be handled for you;

・24-hour response for tenant issues;

・Renewals/cancellations of rental agreements will be handled for you; and

・Restoration of property to original condition after the tenants move out.

PIMS is responsible for all of the above under the terms of the “Master Lease.” This saves the owner from having to get involved with the inconveniences of condominium management.

| Company name | PIM Co., Ltd. |

|---|---|

| Established | September 4, 2001 |

| Capital | 37.5 million yen |

| Location | MFPR Shibuya Building 4th Floor, 1-2-5 Shibuya, Shibuya-ku, Tokyo 150-0025 |

| Company officer |

Koichi Mashima Director, Representative Director, and Chairman of the Board of Directors Katsuya Amano President and Representative Director Haruhiko Imasaka Managing Director |

| License | Real Estate Brokerage Governor of Tokyo (5) 80124 |

| Member of |

All Japan Real Estate Association All Japan Real Estate Federation |

| Banks |

|

| Leagal advisor | Ginza Ekichika Law Office Masami Ishikawa, Attorney |

| Tax accountant | Tokyo Chuo Tax Accountants Konin Taue, Accounting Office |

| Group companies |

Urbanest Co., Ltd. Frontier Agent Inc. K's Realty Co., Ltd. Oakit Co., Ltd. PIM Partners Co., Ltd. |

Contact Us

・Please use the form below to apply for the individual consultation . (Everything is conducted in Japanese .)

・Online consultation (online meeting) is available upon your request.

・After submitting this form, you will receive a confirmation e-mail (in Japanese).

・Please reply to the e-mail with your request for an individual consultation and preferred date and time or a specific inquiry.